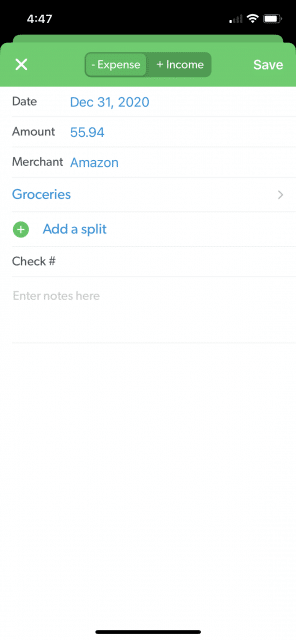

You’ll be more confident in your financial life, have a better handle on your cash flow. The end result, however, is well worth it. Final Thoughts on You Need a Budget YNABīe patient with yourself it’s a process. Estimate from old bills, bank statements, or your best recollection of how much you spend per month on each area.Ĭhances are, for the first several months you will need to make a lot of adjustments to cover the gap between what you think you spend and what you actually spend. When you first start using YNAB (or any other budgeting tool), you’ll need to be a little bit forgiving with yourself. When we first started budgeting, I really thought we only spent a few hundred per month on groceries! Turns out, it’s closer to $1000 (we are working on this!) It’s eye-opening to see exactly how much we spend on groceries, for example. It lets me track each of our monthly expenses so that I understand exactly where all of our money is going. I don’t know what I ever did before using YNAB, but this tool is amazing. This cushion can be a huge stress-reliever and allow you to roll with the punches when life happens. Eventually, you’ll “age your money” so that you have at least a month’s worth of expenses covered in advance. That is, once you get your budget under control and spend less than you make, you begin to have a little left over each month.

Some were easy (car insurance) while others are still a work in progress (grocery shopping!) I pick one budget item at a time and look for opportunities to improve it. I started doing this in a series called Optimize Everything.

Optimize spending: One of the biggest benefits of budgeting, in addition to seeing where all your money goes, is the ability to identify all of your line-item expenses, and optimize your spending in each one.Recognizing this lets you shift spending from one category (ex. It can be eye-opening to see how your budget does, or does not, fit with your long-term goals. Are you spending hundreds of dollars on clothes each month, when your real life’s goal is to travel the world? If so, your spending is not aligned with your goals. Align spending with priorities: In addition to showing where all of your money goes, it can help you align your spending with your priorities.Their support staff is also top-notch I’ve reached out to them several times with questions, and they are always responsive and helpful. While you don’t need to buy YNAB in order to access the blog or classes, they definitely go together well. You’ll also find a blog with good information on important financial topics like emergency funds, credit card management, and investing.

0 kommentar(er)

0 kommentar(er)